‘FundMore Score’ and ‘Results’ Widget

Product Feature Guide

Table of Contents

Introduction

The FundMore Score is a decision support tool to assist lenders with making decisions efficiently. It lists parameters per lender limitations on LTV, GDS, TDS, FICO score, loan amount, and other details. These parameters are defined by the Lenders and configured by FundMore accordingly. Essentially in 90% of the cases, as long as there is a field within the LOS then we can use that for the score. There may be exceptions for data points that may be harder to get to.

Future state will enable the clients to self configure the FundMore score parameters themselves within the FundMore Score section of the Manager Portal.

FundMore Score Tab

FundMore Recommendation - The green box in this widget shows the action recommended by FundMore.ai (for example, whether to decline or accept the application). Where the recommended action is to decline the application, details about what is needed in order for the application to be approved (for example, an uploaded credit report) are shown.

FundMore Score - This section provides a summary of all parameters according to their status: passed, failed, or identified as a risk. This is used to identify possible risks that might need to be actioned on the application.

Parameter List - The details of the score are shown on the right side of the widget in the parameter list. Coloured bars for each parameter indicate whether the parameter has passed, failed or been identified as a risk.

|

Parameter Colour |

Description |

|

|

Parameter has passed |

|

|

Parameter is an identified risk |

|

|

Parameter has failed |

Rate Matrix Tab

The Rate Matrix tab shows the product feasibility relative to the deal. It contains the same components as the FundMore Score tab, but displays the parameters specific to the product selected for a given application. These parameters are set up in the ‘Products’ section of the Manager Portal.

Default Parameters

FICO/Credit Score - Input any value.

GDS/TDS < 50

Application Type = Any

LTV </= 75

Mortgage Position = 1st or 2nd

Lending Area = ON & AB

Minimum & Maximum Loan Amounts = None.

Risk Warnings

Our FundMore score can support the definition of Risk Rules. These risk rules are flags that FundMore can configure for each lender, that show up automatically when certain properties on the application are out of the risk thresholds of the lender. When risks are identified, the FundMore Score will enumerate the risks and as the lender works to reduce them, they will gradually go away.

Risk Warnings List:

They are segmented into categories. Any of the below risk warnings can be added for you and if there are any that you do not see on the list, we can easily add them.

Other

- [x] Application type is Pre-Approval

- [x] Closing date is < 5 days

- [x] Client is < 18 years old

- [x] Client is separated or divorced

- [x] Q GDS is > 39%

- [x] Q TDS is > 44%

- [x] Mortgage rate type is Variable

- [x] Annual Property taxes are < 1% of the purchase price

- [x] Annual Heating Cost is < $1,200

- [x] Application has > 2 applicants

- [ ] Current address in different province than subject property

- [x] Client identified as PEP/HIO

- [x] Applicant is a Corporation

- [x] Occupancy is Second Home

- [x] Mortgage type is not a First Mortgage

- [x] Mortgage is being ported

- [x] Repayment type is Interest only

- [x] Amortization is > 25 years

- [x] Guarantor is present on the application

- [x] Client identified in name screening

- [x] Client risk score is 100 or greater

- [ ] Client current address is linked to a hotel/jail/mail drop

- [x ] HRC has been checked

- [x ] Client identified as having No New Business Permitted-Refer to Fraud/AML Compliance

- [x ] Client identified as having a Power of Attorney on file

- [x ] Non-primary applicant identified as having a Power of Attorney on file

- [x ] Client identified as being No Renewal Permitted- Refer to Fraud/AML Compliance

- [x ] Non-primary applicant identified as being No Renewal Permitted- Refer to Fraud/AML Compliance

- [x ] Client identified as having a Third Party Determination

- [x] Unknown applications are not supported (relates to the Purpose field top right hand corner of the Summary tab). Needs to include what has been entered for Application Purpose, i.e. Application Purpose = Refinance. Purpose should read Refinance for Debt Consolidation. The inclusion of the word Refinance will clear the warning.

- [X] Non-Primary Applicant identified in name screening

- [X] Risk score is 100 or greater for non-Primary applicant(s)

- [x] Non-primary applicant identified as PEP/HIO

- [x ] Non-primary applicant identified as having a Third Party Determination

- [x ] Client identified as being a High Risk Client

- [x ] Non-primary applicant identified as being a High Risk Client

- [x ] Non-primary applicant identified as having No New Business Permitted-Refer to Fraud/AML Compliance

Property

- [x] Property is not MLS listed

- [ ] Property is rural

- [ ] Property is a Rental/Investment Property - Missing Rental Property type

- [x] Property shows an Environmental hazard

- [x] Property is on a Septic system

- [x] Property is on Well water

- [x] Property Tenure is Leasehold

- [x] Property is a Mobile home

- [x] Property is > 2 units

- [x] Property is < 650 square feet

- [x] Property is > 15 acres

- [x] Property is new construction

- [x] Application is a Purchase Plus

- [x] Property Address is not residential (hotel/jail/business)

- [x] Secondary Market Uninsured

- [ ] Property is outside of lending area

Loan Amount

- [x] LTV is > 95%

- [x] Purchase Price is > $500,000

- [x] LTV is < 80%

- [x] Purchase Price is =/> $1,000,000

- [ ] Mortgage is more than 2 million (i.e. $2MM)

Credit

- [x] Credit Score < 600

- [x] Collection/Judgment showing on Credit Bureau

- [ ] Active tradelines are < 12 months

- [ ] DOB/SIN Mismatch

- [ ] Previous Bankruptcy on credit bureau

- [ ] Address Mismatch

- [ ] Consumer Alert on credit bureau

Income

- [ ] Client has < 1 year employment tenure

- [ ] Client has income/investment in high risk country

- [ ] Employment address is residential

- [ ] Mismatch details on employment letter/pay slips

- [ ] Client identified as having Income from Prohibited/High Risk Country

- [ ] Non-primary applicant identified as having Income from Prohibited/High Risk Country

Down Payment

- [x] Down payment source is "other"

- [ ] Client identified as having a Down Payment coming from Prohibited/High Risk Country

- [ ] Non-primary applicant identified as having a Down Payment coming from Prohibited/High Risk Country

- [ ] Client identified as having a Gift coming from Prohibited/High Risk Country

- [ ] Non-primary applicant identified as having a Gift coming from Prohibited/High Risk Country

Restricted Closing Date

Note: This is a tenant setting. Please contact the Client Success team to have it enabled in your environment.

- [ ] Closing Date is scheduled for a restricted date.

For information on how to configure these dates, refer to the Restricted Dates PFG.

- A restricted closing date warning has been added for closing dates flagged as restricted. This feature is tenant-configurable and can be enabled upon request by contacting the Client Success Team.

LTI

Note: This is a tenant setting. Please contact the Client Success team to have it enabled in your environment.

- [ ] LTI is higher than the Maximum: Displayed when the LTI exceeds 4.5x. No

Admin users can configure an increment that addresses cases when the LTI exceeds 4.5x within the Manager Portal.

This configurable increment provides flexibility for clients to adjust risk factors based on their unique criteria. Users can apply this LTI-specific increment directly from the Increments list in the application’s UI, allowing easy adjustments where necessary.

Lenders can manage their own LTI risk configurations in the Settings tab of the Manager Portal.

Available risk ranges include Low Risk (Green bar), Moderate Risk (Yellow bar), and Maximum LTI (Red bar). These thresholds can be customized based on individual risk tolerance, aligning with regulatory standards such as OSFI updates.

Fields for Low Risk Minimum (defaulting to 0), Moderate Risk Minimum, and Maximum LTI Minimum are user-editable, while maximum values auto-adjust based on these inputs.

‘Results’ Widget

The Results widget shows the borrower’s score on the five key elements necessary for a successful application: credit, collateral, character, capacity, and capital (the 5 “C”s). The score is shown on a bar chart, and when you hover the mouse pointer over a bar, you can see the numeric score. The formulas created for the Results attempt to apply a score based on a range of possible values. Values on the lower end of the range (not ideal) will get a lower score. Values on the higher end of the range (ideal) will earn a higher score.

Note: It should be mentioned that this logic dates back to when the system was first developed, and may be revised in the future.

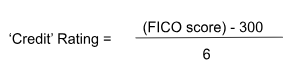

Credit

The ‘Credit’ rating is directly related to the primary applicant’s FICO score. There are 600 points between the lowest and highest possible scores. Each point above 300 increases the rating by ⅙.

Collateral

The “Collateral” rating is directly tied to the overall FM Score. The rating will improve the fewer warnings or fails there are in the FM Score.

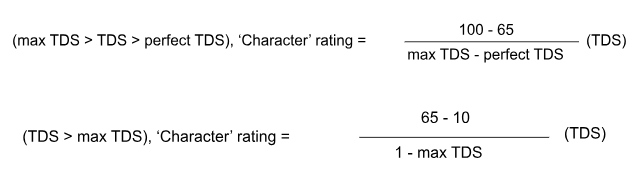

Character

The ‘Character’ rating is directly related to the value set for the maximum TDS and that set for the ‘perfect’ TDS. In preview instances, the maximum TDS is set to 44% and will receive a rating of 65. The perfect TDS is set to 25% and will receive a rating of 100. A TDS equal to 100% will generate a rating of 10.

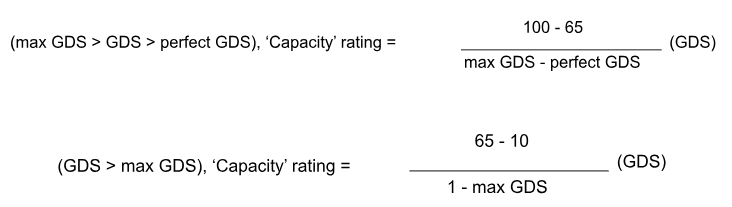

Capacity

The ‘Capacity’ rating is directly related to the value set for the maximum GDS and that set for the ‘perfect’ GDS. In preview instances, the maximum GDS is set to 39% and will receive a rating of 65. The perfect GDS is set to 25% and will receive a rating of 100. A GDS equal to 100% will generate a rating of 10.

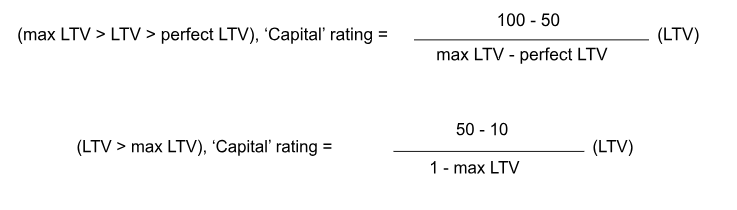

Capital

The ‘Capital’ rating is directly related to the value set for the maximum LTV and the value set for the ‘perfect’ LTV. In preview instances, the maximum LTV is 80% and will receive a rating of 50. The perfect LTV is set to 0.8% and will receive a rating of 100. An LTV of 100% will generate a rating of 10.

![Fundmore-Logo.png]](https://help.fundmore.ai/hs-fs/hubfs/Fundmore-Logo.png?height=50&name=Fundmore-Logo.png)