Broker Management

Product Feature Guide

Table of Contents

Broker Management and System Permissions

Broker Management Items, Description & Functionality

Adding a Broker in Manager Portal

Adding a Broker at the Application Level

Blocking Multiple or All Unverified Brokers

Deleting Multiple or All Unverified Brokers

Broker Management: Implementation at the Application Level

Introduction

The Broker Management section in the Manager Portal allows lenders to efficiently manage their broker list. Key features include adding new brokers, editing broker details, assigning and updating risk scores, updating broker statuses (i.e. Verified or Unverified, and Approved or Blocked), and deleting a broker.

The broker’s list is divided into two segments: Verified and Unverified. Verified Brokers are those that are already entered into the system and confirmed as valid. These brokers can have a status of either Approved or Blocked. On the flip side, Unverified Brokers are brokers not currently in the system but who have submitted an application to the lender. The system automatically adds them to the unverified list, flags their name in the application, and updates the unverified list count in the Broker Management section. This serves as a visual cue for the lender to verify and approve the broker. This will be discussed in more detail within the guide.

Broker approval is a manual process. Typically, when onboarding, lenders upload their list of active brokers directly into the verified section. Subsequently, when an application is received, the system cross-references the submitting broker(s) against the Broker Management list. Verification status is determined by trying to match by License Number (only by License Number) first, if there is no match then we try to match the broker’s First Name, Last Name, and Email Address. If any of these fields do not align with the records in Broker Management, the system adds the broker to the unverified list as a new entry.

Unapproved or unverified brokers can still be linked to applications, but only through manual addition at the application level. When added this way, they are placed in the "Unverified" list in the Manager Portal and will remain unverified until their status is updated. The system will provide visual indicators to highlight the broker’s unverified status at the application level.

Note: POS systems (e.g., Filogix, Finmo, Velocity) transmit brokers’ license numbers and phone numbers upon initial creation (the first time a broker submits an application via the POS). These details are stored in the FundMore database, and they populate in both the Broker Management section and the Stakeholder’s Details widget in the UI.

Broker Management can be found in the Manager Portal. To find it:

- Navigate to the Manager Portal from the top menu.

- In the Manager Portal, select Broker Management from the left sidebar.

Broker Management and System Permissions

Access to the Manager Portal, including the Broker Management section, is determined by user permissions. Permissions can be customized in the Roles and Permissions Management section to provide specific access to users based on their roles and responsibilities, ensuring that access is tailored and secure.

Lenders can grant specific permissions to users who need to manage brokers within the system. The "Manage Brokers in Manager Portal" permission grants users access exclusively to the Broker Management section. This setup hides other sections of the Manager Portal, including history logs, from the user's view. It is designed for users who need to handle broker-related tasks without requiring broader access to the system. On the other hand, the "Manage System Configuration" permission provides unrestricted access to the entire Manager Portal, including all sections and features.

For instance, if a Business Development Manager (BDM) only needs to oversee the Broker Management section, the "Manage Brokers in Manager Portal" permission can be activated for their role, while the "Manage System Configuration" permission is disabled. This ensures the BDM can focus solely on managing brokers without access to unrelated system configurations.

Below is a depiction of the Manager Portal interface for a user restricted to Broker Management access:

Broker Management Items, Description & Functionality

Search Box - Located on the top left of the section just below the top header ‘Broker Management’. In the search box, you are able to enter text/keywords related to the previously created brokers in either the Verified or Unverified list. All Brokers with the search criteria will appear in a list below.

Sort Functionality - You can sort the list by ascending or descending order. Simply click on the arrow icon next to the column header you wish to sort by. When the arrow points upwards, the list is sorted in ascending order; when it points downwards, it is sorted in descending order. The arrow in the sorted column will remain fixed, indicating your chosen criteria.

| Ascending: | Descending: |

Verified/Unverified Buttons - These tabs list the brokers that are either verified or unverified. Selecting the Verified option will show the verified brokers in a list view. Selecting the Unverified option will show the unverified brokers in a list view. The orange-colored counter on the top right of the unverified tab indicates the number of unverified brokers in the system. It serves as a visual indicator for system administrators, highlighting brokers in the unverified list that require attention.

‘Add a New Broker’ Button - Enables you to add a new broker. When selecting this button a pop up will appear with fields to input data. The fields consist of: First Name, Last Name, Cell Phone, Email, Brokerage, Risk Score and Approved checkbox.

Scroll Bars - - Depending on the size of the screen, these will be located at the bottom of the list of brokers and to the far right of the screen. Use these to scroll horizontally or vertically to see what does not fit on the page.

Items Per Page - Depending on your list, you may have more than one page of brokers. To navigate through pages use the ‘Items per page’ navigation at the bottom right hand side of your screen. With this functionality you can indicate how many items per page you would like to see - 10, 15, 25, 50, or 100. You can also see how many pages there are and scroll forwards and backwards through the pages.

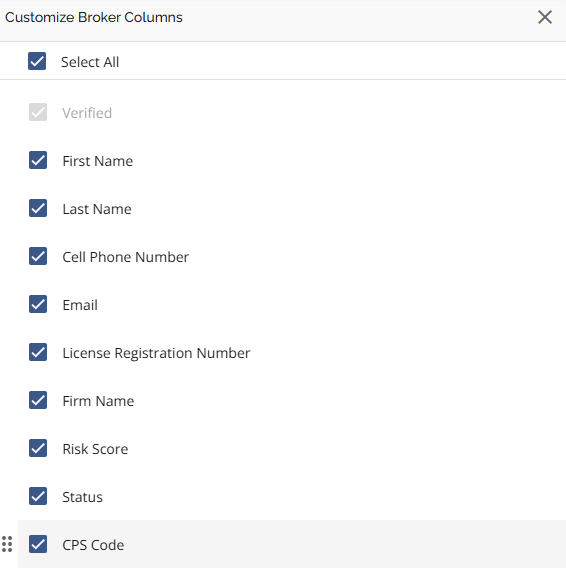

Customize Table Button - This functionality enables users to select the specific columns they want to view in the table and arrange them in their preferred order. Here is a video demonstration of the steps outlined below: Customize Broker Management Table.

To customize the Broker Management table, follow these steps:

- Click on the Customize Table icon.

- A sidebar will appear on the right side of the screen.

- Select which columns you want to display in the table by checking the corresponding checkboxes next to the column names.

- To rearrange the order of the columns, hover to the left of the checkbox. When the drag icon appears, click and drag it to your preferred position.

- Once you close the sidebar, the broker management table will automatically update to reflect your selections and column arrangement. Your changes will hold until new changes are made.

Note: If any of the Broker Management fields discussed below is not visible, it may be due to how the table is customized.

Broker Management Fields - These are the key data fields used to manage and track brokers within a system. These fields include:

First Name - The first name of the broker. Passed to FM via POS. 1st data point used in broker matching.

Last Name - The last name of the broker. Passed to FM via POS. 2nd data point used in broker matching.

Cell Phone Number - The cell phone number of the broker.

Email - The email address of the broker. Passed to FM via POS. 3rd data point used in broker matching.

License Registration Number - The license number of the broker. This will populate automatically upon ingestion from the POS systems. This field can be edited if necessary.

Firm Name - The brokerage which the broker works for.

Risk Score - The risk score of the broker. This is a rating functionality completely at the discretion of the lender and is for informational purposes only. It will not impact the workflow of applications. Values range from 0 - 5 with 0 being the least risk and 5 representing the most risk. The risk score is managed in the Manager Portal and is visible within applications in the pipeline. If you do not wish to use this functionality, simply assign all brokers with the same score i.e. 0.

This functionality was built with the original intention that lenders would use this as a scoring mechanism when they needed to indicate a mark against (strike) a broker for whatever reason. Brokers would start out with a risk score of 0 and for each “incident” the risk score would be increased until the maximum of 5 was reached at which time they would most likely cut the broker off.

Verified Checkbox - Appears in the Unverified list only. This checkbox is used to indicate if the broker is verified. It is to be selected if the broker meets the requirements of approval by the lender. If it is not checked, it means this broker does not meet the requirements or has not been reviewed based on the approval requirements.

Status - Appears in the Verified list only. This field indicates the status of a verified broker. There are two options: approved or blocked. If a broker is approved, a green approved icon will appear inline with their information. On the flip side, if a broker is blocked, a red icon will appear inline with their information.

CPS Code - A unique code specific to one lender. Leave this blank if it means nothing to you.

| Approved: | Blocked: |

Ellipsis - Clicking on the ellipsis opens up a dropdown menu with four options: Edit, Approve, Block, Delete.

Approve - Marks a broker as approved.

Block - Marks a broker as blocked.

Delete - This is used to remove the broker from the system. Selecting this option will open a pop-up window asking the user to confirm their action. Click on the Remove button to permanently delete the broker. Alternatively, you can click on the Cancel button to cancel the action.

Note: When a broker is deleted from the system via the Manager Portal, their information is removed from the Broker Management list, ensuring they no longer appear in any category, Verified or Unverified. If that broker is associated with a deal, their information will remain linked to that deal. The system will simply flag such brokers as unverified at the application level, providing a clear indicator that their status requires attention.

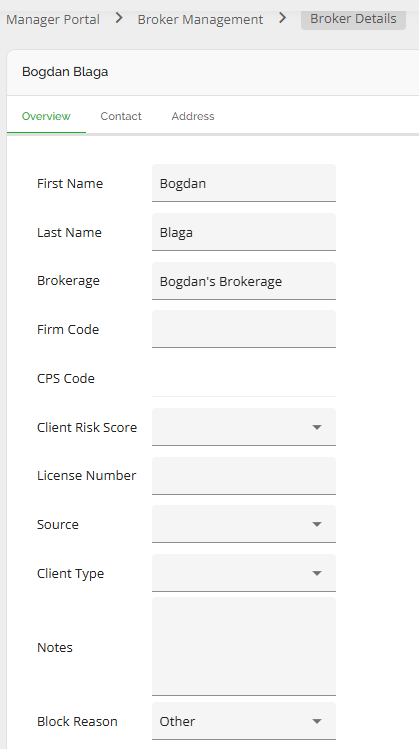

Edit - Opens up an expanded view of the Broker Details. Within this interface, there are three tabs: Overview, Contact, and Address.

- The Overview tab displays general details about the selected broker, including First Name, Last Name, Brokerage, Firm Code, Client Risk Score, Source, Client Type, and Notes. Except for the Firm Code, all information in this tab is editable. Any changes made are automatically saved.

The Firm Code is passed from the POS to FM during ingestion.

Note: Broker commissions are driven by the Brokerage Name, which is set up in the Broker Management section and displayed at the application level in the Stakeholder Details widget. If the Brokerage Name field is not populated, the commission amount may not be properly applied. It is essential to ensure this field is accurately filled to avoid missing commission data.

Within the product setup, lenders have the flexibility to define commissions that can either apply to all brokerages (when the Brokerage Name field is left blank) or be specific to a particular brokerage. It is important to note that the system requires an exact match for the Brokerage Name. This includes case sensitivity, spacing, and special characters. For instance, "Pineapple Brokerage," "Pineapple brokerage," and "Pineapple" are considered different entities. Any discrepancies in the name will result in the commission not being applied correctly.

The configuration rules for assigning commissions are as follows:

- General Commission (Null Brokerage Field): If no Brokerage Name is specified in the product setup, the commission applies universally to all brokerages.

- Specific Commission (Populated Brokerage Field): If a specific Brokerage Name is entered in the product setup, the commission is applied exclusively to deals associated with that exact brokerage.

In terms of the precedence of Specific Brokerage Commissions, if a product setup contains multiple commission entries with the same term and term type but different amounts—one with a populated Brokerage Name and the other with a null Brokerage Name—the entry with the populated Brokerage Name takes precedence.

When a broker submits a deal, or if a product is changed and reapplied to an existing deal, the system evaluates the Brokerage Name in the broker's profile against the product setup. If there is a match, the appropriate commission is automatically applied and displayed within the Broker Commissions tab of the Loan Details widget. This ensures that the correct commission is assigned to each deal based on the configured rules.

- The Contact tab displays the contact information for the selected broker, including their Email, Cell Phone, Work Phone, Home Phone, and Fax Number. Users are able to update this information and indicate what the broker’s preferred contact method is. Any changes made are automatically saved.

- The Address tab displays the broker’s address and type of address. Within this tab, users can indicate which address is the current address in the case of multiple addresses. Users can easily search for addresses due to our integration with Google Maps, ensuring a smooth and more reliable experience. All information in this tab is editable. Any changes made are automatically saved. To delete an address from the list, simply click on the in-line ellipsis and select the Delete option.

Adding a Broker in Manager Portal

To add a broker to the list, follow these steps:

- Click on the Add New Broker button.

- Enter the relevant information in the pop-up window. This includes their First Name, Last Name, Cell Phone, Email Address, Brokerage, and Risk Score (from 0 to 5). Following these fields is the ‘Approval’ checkbox, which is an optional field at this point.

- Once all fields are completed, select the Create Broker button.

Note: When adding a broker, the system currently does not notify users if the broker is already in the system. If the details entered exactly match an existing broker's record in the Manager Portal, the system will return an error. However, slight variations in details, such as a different email address or phone number, will result in a duplicate entry. It is the responsibility of admin-level users to periodically clean up duplicate entries in the system to maintain accurate records.

Brokers added manually can only be added to the Verified section. The thought process here is that if the lender is manually adding a broker, they are already verified. The Add New Broker button is disabled in the Unverified section, as this section is automatically populated with the details for any new broker who submits an application via a POS system. The term ‘new broker’ refers to a broker that is not currently listed in Broker Management, or one whose details do not fully match entries already in the system i.e. First Name, Last Name, and Email.

Adding a Broker at the Application Level

The Broker Management functionality includes the ability to automatically add a broker to the Manager Portal when a new broker is created within a deal. This streamlines the process of managing brokers and ensures that brokers, even those added at the application level, are accurately tracked within the system.

When a new broker is added at the application level, they are automatically added to the Unverified tab in the Broker Management section of the Manager Portal. The user with appropriate permissions can then navigate to this section to approve and verify the broker. Once the broker is verified and approved, their status is updated in the deal, reflecting their new verified and approved status.

The ability to add a broker to an application is permission-based. Users with the “Add stakeholder to application” permission are able to perform this action. It is important to note that for this permission to function, the role also needs to have the “Update application in any stage” permission enabled.

To add a new broker at the application level, follow these steps:

- Navigate to the application from the Pipeline View.

- Go to the Stakeholder’s Details widget (by default, it is the last widget in the Dashboard).

- Click on the Edit icon (

) in the top right corner of the widget .

- Click on the Add Stakeholder button. This is signified by the green plus button.

- From the dropdown menu, choose the Agent type.

- Enter the details in the pop-up sidebar. Mandatory fields are marked with an asterisk (*).

- Once completed, click on the Add Stakeholder button.

This feature enhances workflow efficiency by minimizing the need for repetitive data entry. To better understand this functionality, click on this link to watch a video demonstration.

Note: When adding a broker, the system currently does not notify users if the broker is already in the system. If the details entered exactly match an existing broker's record in the Manager Portal, the system will return an error. However, slight variations in details, such as a different email address or phone number, will result in a duplicate entry. It is the responsibility of admin-level users to periodically clean up duplicate entries in the system to maintain accurate records.

The newly added broker will be flagged by the system as an Unverified Broker. This does not impede progress on the deal. To verify and approve this broker, you can refer to the Verify or Approve a Broker section.

Verify or Approve a Broker

To verify or approve an individual broker, follow these steps:

- Navigate to the Broker Management section in the Manager Portal.

- If the broker is not verified, go to the Unverified tab. Otherwise, remain in the Verified tab.

- Locate the broker you intend to verify or approve.

- Choose one of the following options:

Option 1 (Unverified Tab Only):- Use this option to simultaneously verify and approve an unverified broker.

- Click the checkbox next to the broker’s name.

- Once selected, the Approve button at the top of the page will be enabled.

- Click the Approve button or the down arrow next to it to select “Approve” from the dropdown menu.

- Once Approved, they will automatically be moved from the Unverified list to the Verified list.

Option 2 (Both Verified and Unverified Tabs):

- Use this option to approve a verified but blocked broker or to simultaneously verify and approve an unverified broker.

- Click the inline ellipsis next to the broker’s name.

- In the dropdown menu, select the “Approve” option.

If the broker was unverified, they will automatically be moved from the Unverified list to the Verified list.

Multi or Bulk Verification

To verify or approve several brokers simultaneously:

- Navigate to the Broker Management section in the Manager Portal.

- Select the Unverified tab.

- Click the checkbox next to the name of each broker you wish to verify or approve. To select all brokers in the list, click the checkbox next to the column headers.

- Once brokers are selected, the Approve button at the top of the page will be enabled.

- Click the Approve button or the down arrow next to it to select “Approve” from the dropdown menu.

All selected brokers will be verified or approved and automatically moved from the Unverified list to the Verified list.

After successful verification:

- The counter next to the Unverified button will decrease.

- If all brokers are verified in bulk, the counter may disappear entirely.

Note: Once a broker is verified, they cannot be moved back to the Unverified list. To handle this, we have provided functionality for a broker to be verified without being approved (i.e., marked as verified but blocked).

Block a Broker

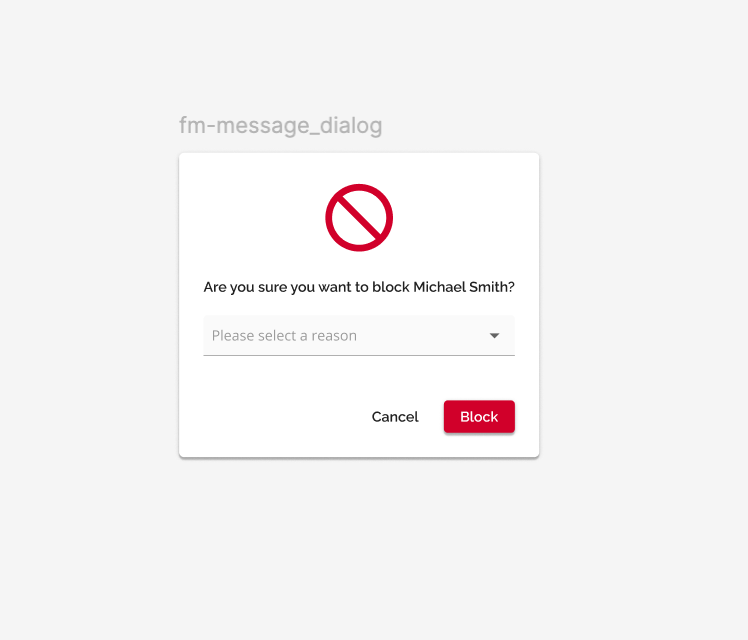

Blocking Individual Brokers

To block brokers from either the verified or unverified lists:

- Navigate to Broker Management in the Manager Portal.

- Locate the broker you intend to block within the respective list.

- On the far right-hand side of the row, click the inline ellipsis icon.

- In the dropdown menu that appears, select the “Block” option.

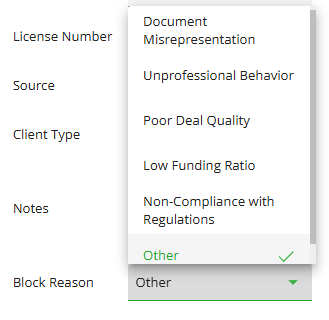

5. A pop up will show up. Select the reason you are blocking the broker. Note, a reason is required to block a broker to ensure consistency in reporting and decision making. Reasons are self managed via Custom Fields.

6. Select Cancel or Block

The block reason will populate in the Broker Details -> Overview Tab beneath the Notes.

Users with access to Broker Management are able to change the block reason if necessary. To do so, they would simply open up the drop down menu in the Block Reason section of Broker Details -> Overview tab and select another option from the list.

If the broker was unverified, they will automatically be moved from the Unverified list to the Verified list.

If a broker’s status is changed from Blocked to Approved the Block reason will disappear from viewBlocking Multiple or All Unverified Brokers

To block multiple or all unverified brokers:

- Navigate to Broker Management in the Manager Portal.

- Go to the Unverified section.

- Click the checkbox next to the name of each broker you wish to block. If you wish to select all brokers in the list, click the checkbox next to the column headers.

- Once brokers are selected, the Verify button will be activated. Click the down arrow next to this button.

- Choose the “Block” option from the dropdown menu.

The selected brokers will be automatically blocked in the list. If the broker was unverified, they will automatically be moved from the Unverified list to the Verified list.

Note: Mass blocking is only available in the Unverified list.

Edit Broker Details

Broker details can be edited inline or via an expanded view in both the Verified and Unverified lists. The system will automatically save any updates made. FundMore supports a one-way sync, meaning any updates made within the Manager Portal will reflect in active applications only. Historical applications for updated brokers will retain the original data.

Inline Edits

- Navigate to Broker Management in the Manager Portal.

- Locate the broker you wish to edit within the Verified or Unverified list.

- Click directly on the editable fields (e.g., name, email, or other details).

- Make the necessary updates. The system will automatically save the changes.

Expanded View Edits

- Navigate to Broker Management in the Manager Portal.

- Locate the broker you wish to edit.

- Click the inline ellipsis icon next to the broker’s name.

- In the dropdown menu that appears, select the Edit option.

- The expanded broker details view includes three tabs: Overview, Contact, Address.

- Make the necessary updates in the relevant tabs. The system will automatically save the changes.

Note: If an agent’s license number changes, the lender must request that FundMore update it in the database. After the initial creation, the license number will not automatically update, even if changed in the POS system.

Delete a Broker

Deleting Individual Brokers

To delete brokers from either the verified or unverified lists, follow these steps:

- Navigate to Broker Management in the Manager Portal.

- Locate the broker you intend to delete within the respective list.

- On the far right-hand side of the row, click the inline ellipsis icon.

- In the dropdown menu that appears, select the “Delete” option.

Deleting Multiple or All Unverified Brokers

To delete multiple or all unverified brokers:

- Navigate to Broker Management in the Manager Portal.

- Go to the Unverified section.

- Click the checkbox next to the name of each broker you wish to delete. If you wish to select all brokers in the list, click the checkbox next to the column headers.

- Once brokers are selected, the Verify button will be activated. Click the down arrow next to this button.

- Choose the “Delete” option from the dropdown menu.

The selected brokers will be automatically deleted from the list.

Note: Mass deletion is only available in the Unverified list.

When a broker is deleted from the system via the Manager Portal, their information is removed from the Broker Management list, ensuring they no longer appear in any category, Verified or Unverified. If that broker is associated with a deal, their information will remain linked to that deal. The system will simply flag such brokers as unverified at the application level, providing a clear indicator that their status requires attention.

Broker Management: Implementation at the Application Level

Approved Brokers

Approved brokers are brokers that have been verified and validated by the lender. They are marked with a green badge at the application level, which is displayed in both the Team list and the Stakeholder’s Details widget on the application dashboard.

When adding a broker at the application level, users can search and select from a list of existing verified brokers. Only approved brokers are selectable. Blocked brokers will appear grayed out and cannot be selected, while unverified brokers will not appear in the list.

To enhance user experience, we have provided search and filter functionality when selecting a broker. In the example below, we have filtered the list by Status (Approved) and Brokerage (FundMore). In addition to Status and Brokerage , you can filter by Risk Score. You can refer to this video for a demonstration of this functionality:

Broker Search and Filter Functionality.

Unverified Brokers

Unverified brokers are those either not yet added to the system or added but not yet verified. These brokers are flagged with an orange warning badge in the application’s Team list and Stakeholder’s Details widget.

There are two primary scenarios where a broker is flagged as unverified:

- New Brokers Submitting Applications: Brokers who are not yet in the system or do not match brokers in the system can submit applications to lenders via the POS. Once submitted, they are automatically added to the Unverified list in the Broker Management section. They will be flagged as unverified in the application and the unverified list counter in the Manager Portal will be updated.

- Adding a New Broker at the Application Level: When a broker who is not yet in the system is added at the application level, they will be placed in the Unverified tab within the Broker Management section. The process of adding a new broker within the deal is detailed in the Adding a Broker at the Application Level section. Users with the appropriate permissions can verify and approve these brokers, which will update their status to verified and approved within the application.

Note: If the same broker is added with different details (such as a different name, phone number, or email), the system will flag this as a duplicate entry. It is the responsibility of admin-level users to periodically clean up duplicate entries in the system to maintain accurate records.

Unverified brokers can appear as stakeholders in your application. While there are no hard stops preventing the deal from progressing through the pipeline, it is recommended that lenders set up tasks in the system to ensure broker statuses are reviewed before approving the application.

Blocked Brokers

A broker marked as blocked in the Broker Management system cannot be added as a stakeholder to an application. However, previously approved brokers can have their status changed to blocked for various reasons. If such brokers are already associated with a deal, they will not be automatically removed. Instead, the system flags them as blocked by displaying a red warning icon next to their name in the application’s Team list and in the Stakeholder’s Details widget.

Note: When a broker with a blocked status is associated with a deal, there are no restrictions that prevent the application from moving through the pipeline. Lenders are advised to set up tasks within the system to regularly check broker statuses before deal approval, proceeding based on internal guidelines.

Auto-Decline Tenant-Setting

We have tenant-settings available to auto-decline deals from blocked or unverified brokers. These settings are disabled by default. To enable them, you would need to contact our Client Success Team.

There are two settings to consider:

- Blocked with No Auto-Decline Setting: If the lender has not enabled the auto-decline feature, the deal will not be automatically rejected when submitted by a blocked broker. The system will flag the broker with a red warning icon in the application’s Team list and in the Stakeholder’s Details widget. This warning flag will serve as a visual indicator for users. Lenders are advised to set up tasks within the system to regularly check broker statuses before deal approval, proceeding based on internal guidelines. This workflow is mainly used for blocked brokers. As a reminder, this is a tenant-setting. To have it enabled in your environment, contact the Client Success team.

- Blocked with Auto-Decline Setting: Lenders can enable an auto-decline feature to automatically reject deals involving blocked or unverified brokers during ingestion. As a reminder, this is a tenant-setting. To have it enabled in your environment, contact the Client Success team. Lenders will need to provide a specific decline reason to be used in the configuration for auto-declines. There are two types of blocks to consider:

- Hard Block: This workflow is mainly used for blocked brokers. Deals are declined and moved to the declined stage in the pipeline. The system will flag the broker with a red warning icon in the application’s Team list and in the Stakeholder’s Details widget. The broker will receive an email notification indicating the status of the deal, and the status will be updated in the POS.

- Soft Block: This workflow is mainly used for unverified brokers. Deals are declined and moved to the declined stage in the pipeline. Brokers will receive an email notification explaining their status and that they will be contacted by a team member who can provide assistance. The system will flag the broker with an orange warning icon in the application’s Team list and in the Stakeholder’s Details widget. By default, it is disabled for most tenants and must be requested by the lender.

These features enhance the lender’s ability to manage applications and ensure compliance with their broker approval workflows.

![Fundmore-Logo.png]](https://help.fundmore.ai/hs-fs/hubfs/Fundmore-Logo.png?height=50&name=Fundmore-Logo.png)